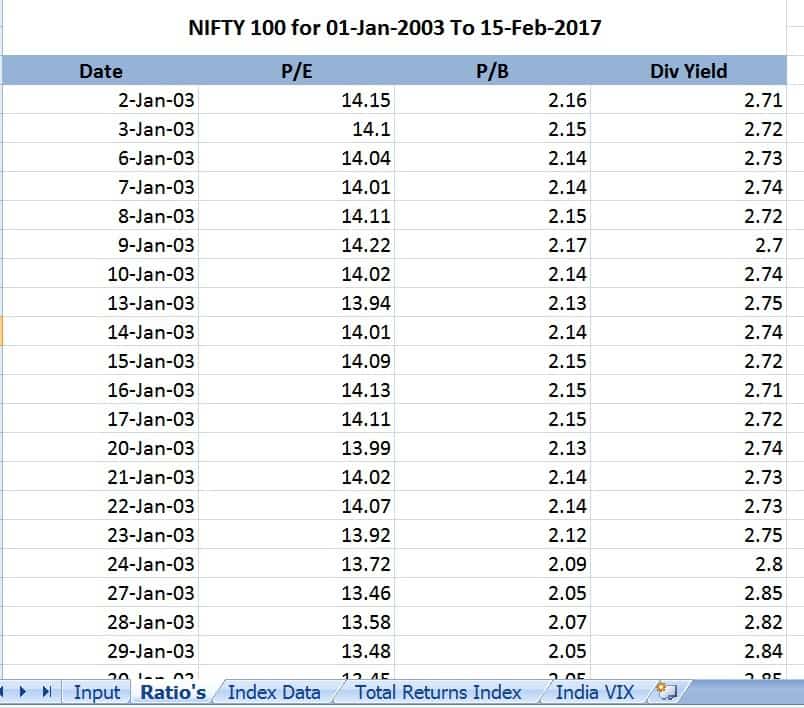

Nifty Dividend Yield / Nifty Candlestick Chart Moneycontrol Stock Market Dividend Yield Data King David Suite / Nifty dividend yield ratio gave the best investment opportunity around year 2003 when it was above 3 level.

Nifty Dividend Yield / Nifty Candlestick Chart Moneycontrol Stock Market Dividend Yield Data King David Suite / Nifty dividend yield ratio gave the best investment opportunity around year 2003 when it was above 3 level.. The index comprises of 50 companies. Nifty is considered to be in oversold range when nifty p/b ratio is below 2.5 and it's considered to be in overbought range when nifty p/b is near 4. Advisorkhoj is a comprehensive source of investment knowledge, financial planning, mutual funds research and helps investors in wealth creation. You can develop your own algorithm to trade and that too without the knowledge of coding using zerodha streak. Annual payout, 4 year average yield, yield chart.

See stocks with the highest dividend yield over the past 1 year, 2 years and 5 years. The index comprises of 50 companies. Therefore, it is the best dividend paying stocks in india. A dividend yield above 1.5 means its a good time to buy. Nifty dividend yield ratio gave the best investment opportunity around year 2003 when it was above 3 level.

Banknifty pe ratio or price earnings ratio is a measure of nifty bank valuation.

The dividend yield is represented as a percentage terms. The dividend yield is the ratio of a company's annual dividend when compared with company's share price. A dividend yield above 1.5 means its a good time to buy. Annual payout, 4 year average yield, yield chart. Dividend option of this fund has declared a dividend of. Nse constituents captures the info. The nifty dividend yield is basically the consolidated dividend yield of all the nifty 50 companies. Click on the column to sort stocks by their current dividend yield. The methodology employs a yield driven selection criteria that aims to maximize yield while providing stability and tradability. Nifty smallcap 250 pe ratio or price earnings ratio is a measure of nifty smallcap 250 valuation. Nifty smallcap 250 pe, pb ratio & dividend yield helps identify oversold and overbought zones of nifty smallcap 250 index. Dividend yield = 100% * (dividend per share / market price. Dividend yields for 2y and 5y have been annualized.

The dividend yield is the dividend per share divided by the market price per share. Dividend yield = 100% * (dividend per share / market price. Click here to open a trading account with zerodha through bse2nse.com and get free training on futures and options trading strategies. The dividend yield is represented as a percentage terms. A dividend yield above 1.5 means its a good time to buy.

As per the historical data shows whenever nifty dividend yield is above 1.75 (higher the number,better the investment opportunity) it has given good long term investment opportunity.

The dividend yield is the dividend per share divided by the market price per share. Nifty / sensex dividend yield % in the last 10 years dividend yield has been at a low of 0.5% in 2001 and at a high of 3% in 2003. See stocks with the highest dividend yield over the past 1 year, 2 years and 5 years. Nifty smallcap 250 pe ratio or price earnings ratio is a measure of nifty smallcap 250 valuation. The dividend yield is represented as a percentage terms. Nse constituents captures the info. Dividend history, recent dividends and dividend yields of nippon india etf nifty bees. Click on the column to sort stocks by their current dividend yield. Dividend yield generally bounces between 1 and 1.5. Advisorkhoj is a comprehensive source of investment knowledge, financial planning, mutual funds research and helps investors in wealth creation. Fund has 97.81% investment in indian stocks of which 87.1% is in large cap stocks. The market price per share is simply the stock price.the dividend per share comes from the most recent income statement. We multiply by 100% and report in percentage terms.

As per the historical data shows whenever nifty dividend yield is above 1.75 (higher the number,better the investment opportunity) it has given good long term investment opportunity. Nifty dividend opportunities 50 tri nifty 50 tri index rebased to 1000 5hihu 'lvfodlphu rq sdjh nifty 50 vs nifty dividend opportunities 50 3361/9.70% cagr. The methodology employs a yield driven selection criteria that aims to maximize yield while providing stability and tradability. Fund has 97.81% investment in indian stocks of which 87.1% is in large cap stocks. Dividend history, recent dividends and dividend yields of nippon india etf nifty bees.

One of the ways companies distribute their profit to shareholders is by giving cash dividends and dividend yield is the ratio of dividend amount to price of the share.

Nifty dividend opportunities 50 tri nifty 50 tri index rebased to 1000 5hihu 'lvfodlphu rq sdjh nifty 50 vs nifty dividend opportunities 50 3361/9.70% cagr. You can develop your own algorithm to trade and that too without the knowledge of coding using zerodha streak. The equity dividend consisting of final, interim and any other special dividend reported by each index constituent in. Dividend yield = 100% * (dividend per share / market price. The dividend yield of the company 10.37% and a payout ratio of 21.94%. Dividend yields have been adjusted for bonus split. Advisorkhoj is a comprehensive source of investment knowledge, financial planning, mutual funds research and helps investors in wealth creation. The nifty dividend opportunities 50 index is designed to provide exposure to high yielding companies listed on nse while meeting stability and tradability requirements. Use nifty pe to compare current valuation of nifty 50 with historic nifty pe, pb & div yield values The dividend yield is the ratio of a company's annual dividend when compared with company's share price. Nifty / sensex dividend yield % in the last 10 years dividend yield has been at a low of 0.5% in 2001 and at a high of 3% in 2003. The nifty dividend opportunities 50 index is designed to provide exposure to high yielding companies traded (listed & traded and not listed but permitted to trade) on nse while meeting stability and tradability requirements. Dividend yields for 2y and 5y have been annualized.

Komentar

Posting Komentar